Rule 179 is intended to be used as a method of advanced depreciation for capital expenditures (assets — traditionally equipment but as of 2018 land and buildings too). Well, you can (and it’s actually legal!). You just have to think outside the box.

Emerging Technology and Niche Equipment

Enter the world of emerging technology and niche equipment. Your first thought might be ‘hey, this article is misleading. I’m here to learn about tax savings on marketing expenses, not equipment’. Well don’t fret, allow me to clarify.

Emerging/niche equipment has unique characteristics vs. ordinary equipment. It might be impressive or lavish, it might be in line with the latest trends, it might only be practical for a sliver of the market, but most importantly it’s differentiated. It stands out.

Therefore, so does the company that owns the equipment. They are unique, they are visionary, they invest to be the best, and if they are smart, this message gets wrapped into their go-to-market strategy. Unique equipment is a great sales and marketing tool.

This holds true for any market. Whether you’re the automotive shop with the latest diagnostic technology or the hardware store with a key-cutting vending machine, unique equipment is everywhere. Some of the biggest trends lately are VR/AR/3D.

I can remember when Virtual Reality was in its infancy. I had tons of video games at home but going to the mall to play the new VR game was just too new and cool to resist. Augmented Reality revolutionizing the label industry: if you haven’t seen wine labels that come to life, it’s time to get out from under your rock.

And 3D, well if you don’t see the 3D trend, then it’s time to get out from under your boulder! Since I’ve spent my career in the visual communications space, I’ll share what I’ve seen from the emergence of 3D in this sector.

How 3D Printing Fits In

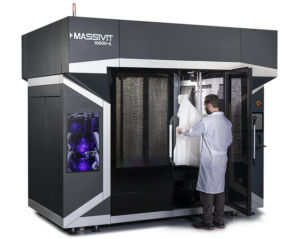

Massivit printing solutions are the world’s first large-format 3D systems geared for the visual/graphic communications market. And while this equipment is used to manufacture products, there is another element to this technology. And that element is strategic sales and marketing.

Our customers (Print Service Providers) are using their Massivit printers to win traditional wide format 2D printing jobs (strategic selling) as well as to open new doors to bring in new customers (strategic marketing). How exactly does this work? It’s called the ‘wow factor’.

The Winning Strategy Of The ‘Wow Factor’

Using the sales example we’ve just mentioned, adding a unique element to an ordinary project can transform the project from ordinary to extraordinary. Why is this strategic? Since the technology is new (only early adopters and visionaries have this equipment; not the mass market) the ‘wow objects’ cannot be created by your other ten competitors fighting you for the same project. You now have a unique solution and thus a viable and differentiated value proposition.

Shifting to a marketing example, nothing opens new doors like the ‘latest’, ‘greatest’, ‘newest’, ‘coolest’, ‘the only one’, etc. Using another example from the graphics industry, many printers struggle to get in front of new clients. Which opening pitch do you think is more likely to get you a meeting: “Hi Susan, this is Sam at Monster Print Factory International. We can print on anything and everything… Our specialty is banners, nobody can beat our banners… When can we meet to discuss?” Versus, “Hi Susan, this is Sam at Monster Print Factory International. We just installed our new 3D printer. It’s unlike anything you’ve ever seen or heard of, it’s massive. In fact, it’s the only 3D printer created for outdoor advertising. We can literally create anything you can imagine, and we are the first company in Arizona with one. When can we meet to discuss?”

The difference is obvious. In terms of winning new customers, I’ve seen companies with a Massivit printer realize their ROI on just this alone. They didn’t even need to sell a 3D object!

Leverage IRS Rule 179

So, don’t get pigeonholed thinking that IRS Rule 179 is only for assets such as production equipment. If you need production equipment, that’s great. But if you’d rather have a top line boost, consider equipment that will enhance your sales and marketing efforts.

As a bonus, it may even help with employee retention too. Learn about IRS Rule 179 for 2019.

Be sure to consult with your legal/tax advisor to make sure your purchases qualify for IRS Rule 179.